In its drive to stimulate the Japanese economy, the Abe government has introduced various fiscal measures for 2016, most notably the accelerated decrease in corporate tax rates and the introduction of a diversified consumption tax. The upcoming VAT increase to 10% in 2017, is likely to be combined with keeping a lower VAT rate at present 8% for sales of food and drink. Below a round-up of the most important measures for the coming fiscal year.

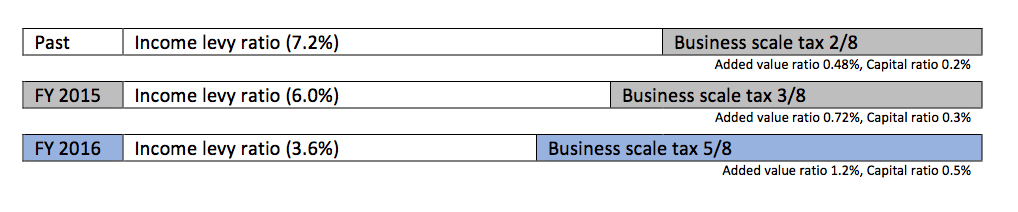

It had been expected that the effective corporate taxation rate would reach the 20% range in 2017. However during the course of the year, PM Abe made a push that he wanted to accelerate the decrease in corporate taxation to encourage growth. For SMEs with an annual income smaller than ¥8 mln the cut in the corporate tax rate itself will however have no effect, as these SMEs will continue to profit from the reduced 15% corporate tax rate for another year (instead of the regular 19%). The following table shows the changes in the composition of corporate taxes over the past year.

% | FY2014 | FY2015 | FY2016 | FY2018 |

Corporate tax rate | 25.5 | 23.9 | 23.4 | 23.2 |

Corporate tax rate SMEs with income < ¥8 mln/y | 15.0 | 15.0 | 15.0 |

|

Enterprise tax income levy | 7.2 | 6.0 | 3.6 | 3.6 |

Effective corporate tax rate (National & local) | 34.62 | 32.11 | 29.97 | 29.74 |

At the same time, the reforms of the corporate taxation system are also designed to have the tax burden shared more broadly among companies (the tax base) and encourage investments. They include measures such as:

Other corporate tax related changes:

Executive compensation rules will see changes with regard to deductible compensation such as pre-determined remuneration, where advance notification is no longer necessary for restricted stock compensation and profit-linked remuneration. Return-on-Investment and other indicators are added to the scope of calculation indicators.

Regional revitalization is also fiscally supported with the introduction of a new corporate edition of the “hometown tax” allowing tax credits when donations are made to businesses that contribute to regional revitalization (max 10% for enterprise tax and max 20% for inhabitants and corporate tax, both on top of 30% donations tax).

Sources: For more details read Ernst and Young Japan Tax Alert of February 2016. In Japanese, an outline provided by the Ministry of Finance in available.

Nikkei (J) reported on December 7th that the LDP Tax System Research Council is planning to half the fixed asset taxes (kotei shisanzei) for SMEs for a period of three years, starting in 2016. The measure would cover purchases by SMEs of new manufacturing or processing machinery or equipment costing more than ¥1,600,000 (approx. €12.000) each and apply to total annual investments totalling more than ¥1 trillion (€7.5 million). The measure would cut the current 1.4% asset tax levied in half. With the move, the government hopes to push domestic capital investment, and improve productivity. An increase in productivity of more than 1% or more efficient energy usage are some of the conditions, in order to be eligible for the cut. Other than in most EU countries, China and South Korea, Japan levies taxes on machinery and equipment subject to depreciation, the move is therefore also seen as bringing the country more in line with the international practice.

Discussions about the introduction of a reduced consumption tax rate when the VAT rate is raised to 10% in 2017 have dominated the news during the past year. In particular, the range of items covered by the reduced rate of 8%, remains a controversial topic between the ruling coalition parties, LDP and Komeito. While the LDP initially took the position that only fresh produce should be covered, regarding a broader scope as a too costly measure, coalition-partner Komeito demanded the addition of processed food as well. The final reforms suggest that Komeito has won the plea, with processed foods, non-alcoholic beverages and subscriptions to newspapers included as well. Where the line will be drawn exactly will continue to be subject of discussions the coming period. While the budget was debated in both Houses of parliament, the PM stated that he would go through with the planned increase, unless ‘a calamity such as the Lehman shock or another natural disaster such as the Great Tohoku Earthquake would occur.’

A new invoicing system, necessitated by the reduced tax rate is still in the works, but there are strong indications that it will have large similarities with the systems present in Europe. The new system will be introduced on April 1, 2021, and until then a simpler, categorized-entry invoice will be used. In Ernst and Young's Japan Tax Alert of February 2016 (pages 5-7) the various changes related to consumption tax are explained in more detail.

With the in-bound tourist boom continuing unabated, in particular fuelled by bakugai (shopping frenzy) tourists from the Chinese mainland, the ruling coalition is planning to decrease the tax-free threshold for foreign tourists. Currently at ¥10.000, the threshold for purchases of goods will be lowered to ¥5.000 next year and will be at the same level as consumables, such as food, medices and cosmetics. Also, procedures to ship tax-free items abroad are simplified and shops are allowed to centralize tax-free shopping procedures at designated counters.The measures are designed to encourage foreign tourists to spend more in regional cities, instead of just visiting major cities. The measures will come into force from May 2016.

With the in-bound tourist boom continuing unabated, in particular fuelled by bakugai (shopping frenzy) tourists from the Chinese mainland, the ruling coalition is planning to decrease the tax-free threshold for foreign tourists. Currently at ¥10.000, the threshold for purchases of goods will be lowered to ¥5.000 next year and will be at the same level as consumables, such as food, medices and cosmetics. Also, procedures to ship tax-free items abroad are simplified and shops are allowed to centralize tax-free shopping procedures at designated counters.The measures are designed to encourage foreign tourists to spend more in regional cities, instead of just visiting major cities. The measures will come into force from May 2016.

From January 1, 2017, the determination of the place of supply in case of B2B digital services provided by foreign service providers to the foreign office of a Japanese business or a the Japanese permanent establishment of a foreign business is changed. Under the new rules, foreign offices of Japanese business that receive digital services solely for foreign sales purposes are no longer subject to consumption tax. Earlier this was regarded as a domestic transaction.

For permanent establishments of foreign businesses in Japan receiving B2B digital services solely for domestic sales purposes however, it will be treated as a domestic transaction and therefore subject to the reverse charge mechanism.

For more details read Ernst and Young Japan Tax Alert of February 2016

The new measure (J), introduced from January 2017, will allow families to deduct costs for over-the-counter medicines over ¥10.000 from their income taxes. The Ministry of Health and Welfare and the Finance Ministry hope such as measure stimulate people to ‘self-medicate’ first, instead of going to a hospital in case of light illnesses, and thus lead to lower costs for national health covered medical care. It is already possible to deduct costs for all types of medicines above ¥100.000 from income tax, but as over-the-counter medicines are usually cheaper, this threshold was hardly reached.

The following changes will come into force with regard to tax administration:

Current corporate taxation breaks for operators of solar energy facilities are likely to end next year, as the ‘Green investment tax reduction” system is reviewed. Under the fiscally beneficial climate, development of solar energy facilities have soared more than initially anticipated in Japan during the past years. The system will continue into the next fiscal year, but solar energy facilities installed after April 1, 2016 will no longer be eligible. Earlier, the government had already introduced lower feed-in tariffs. It is expected that other renewable energy sources, such as wind and geothermal energy facilities will continue to fall under the advantageous fiscal climate, as their spread has lagged behind that of solar energy.

Current corporate taxation breaks for operators of solar energy facilities are likely to end next year, as the ‘Green investment tax reduction” system is reviewed. Under the fiscally beneficial climate, development of solar energy facilities have soared more than initially anticipated in Japan during the past years. The system will continue into the next fiscal year, but solar energy facilities installed after April 1, 2016 will no longer be eligible. Earlier, the government had already introduced lower feed-in tariffs. It is expected that other renewable energy sources, such as wind and geothermal energy facilities will continue to fall under the advantageous fiscal climate, as their spread has lagged behind that of solar energy.

In its quest to stop the declining birth rate, the Japanese government is also taking fiscal initiatives (J) to stimulate its citizens to have more children. Donations made by (grand)parents to their offspring up to ¥10 million earmarked for childrearing related costs were already tax-exempt since 2015, but the scope is expected to be broadened in 2016. Medical costs for infertility treatments and maternity are likely to covered by the system as well.

In its quest to stop the declining birth rate, the Japanese government is also taking fiscal initiatives (J) to stimulate its citizens to have more children. Donations made by (grand)parents to their offspring up to ¥10 million earmarked for childrearing related costs were already tax-exempt since 2015, but the scope is expected to be broadened in 2016. Medical costs for infertility treatments and maternity are likely to covered by the system as well.

Automobile acquisition taxes are abolished in April 2017, and will be replaced with a new, environmental impact-based tax. Cars with a low environmental impact will see a 0% rate.

(J) denotes sources in Japanese

Sources: Ernst and Young Japan Tax Alert of February 2016;

Ministry of Finance, Heisei 28 nendo zeisei kaisei (April 2016) (Japanese);

PwC Japan, 2016 Japan Tax Reform Proposal and impact on individuals on international assignments

The EU-Japan Centre currently produces 5 newsletters :

Joint venture established in 1987 by the European Commission (DG GROW) and the Japanese Government (METI) for promoting all forms of industrial, trade and investment cooperation between the EU and Japan.

The EU-Japan Centre’s activities are subject to the allocation of a Grant Agreement by the European Commission for 2024-2026