Feel free to also consult our latest handbooks:

The EU-Japan EPA Helpdesk also replied many enquiries that are available in our dedicated Q&A page

If you have other enquiries, please use the EPA Helpdesk webform here.

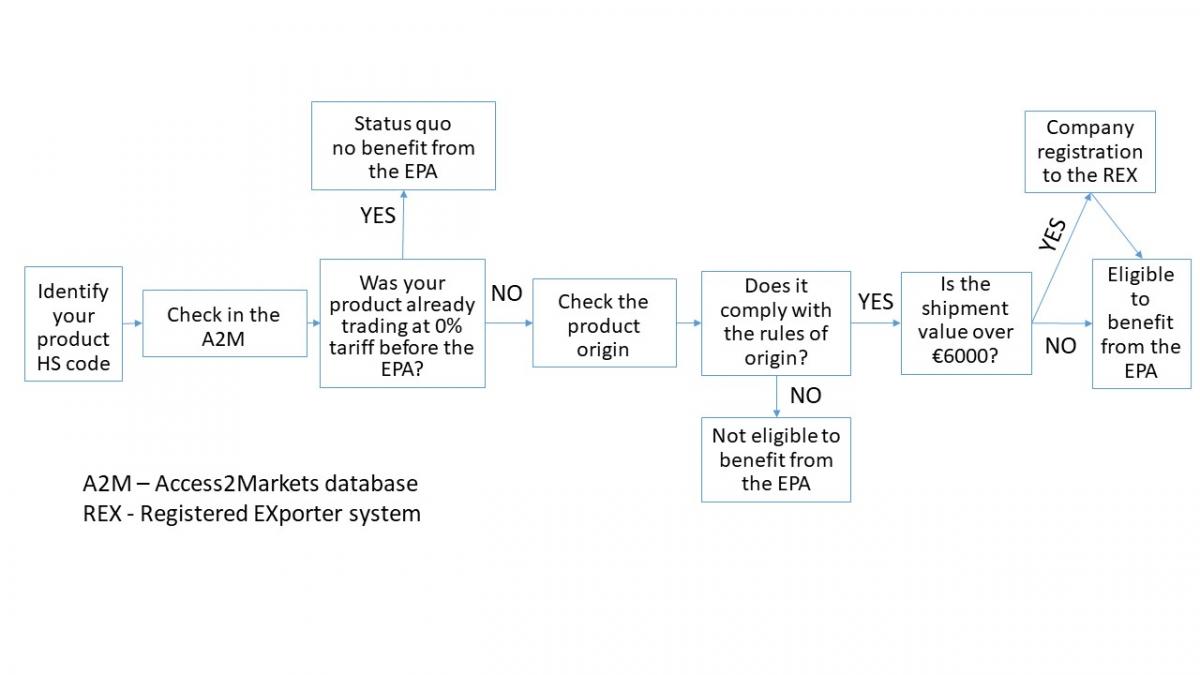

1. Check if the EPA has an impact on your products

The Access2Market database is a portal for EU exporters and importers to find detailed information on: tariffs, rules of origins, trade agreements...

https://trade.ec.europa.eu/access-to-markets/en/content/

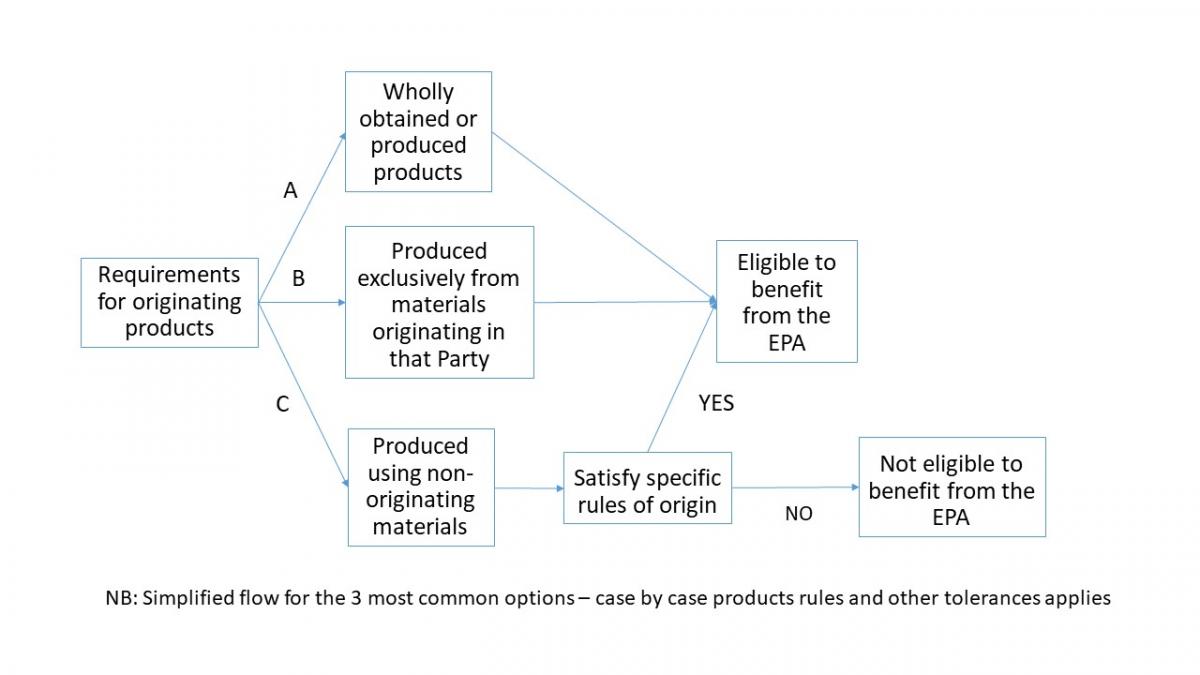

2. Assess the origin of the product

The exporter must check that its product is "made in the EU" and comply with specific rules of origin.

Access2Market database:

https://trade.ec.europa.eu/access-to-markets/en/content/

3. EU exporter to register to the REX if needed

For shipments with a value of more than €6000, the registration to the REX - Registered EXporter system is mandatory.

About the procedures please see:

https://taxation-customs.ec.europa.eu/online-services/online-services-and-databases-customs/rex-registered-exporter-system_en

Pre application online form:

https://customs.ec.europa.eu/rex-pa-ui/#/create-preapplication/

Registration can also be processed by the local customs offices where your company is located.

P.S.

Once registered to the REX the EU company will be able to benefit from all Free Trade agreements the EU has signed with 3rd countries and not just the from the one with Japan.

This point does not apply to Japanese exporters.

4. Exporter to draft a "Statement on origin"

About the filling of the Statement on Origin and procedures to fulfill by the EU exporter, you may also have a look at the guideline provided by the European Commission called “Statement on Origin for multiple shipments of identical products” & the “EU-Japan EPA Guidance, Claim, Verification and Denial”.

See the detailed documents under the: “To implement Section B of Chapter 3 on Origin Procedures, the following Guidance documents have been developed” part.

https://taxation-customs.ec.europa.eu/customs-4/international-affairs/third-countries/japan_en

5. Importer to make a "Claim for preferential tariff treatment"

To benefit from the preferential tariff, the importer will have to submit a "Claim for preferential tariff treatment" to its local customs. This claim can be based on the exporter statement on origin or on the importer's knowledge that the product is originating.

About the "Claim for preferential tariff treatment" made by a Japanese importer resulting in a request for more information by the Japanese Customs.

The Japanese Customs has published information regarding the application in Japan of Article 3.16(3) of the EPA related to the Claim for preferential tariff treatment.

This information aims at addressing questions raised by importers in Japan and exporters in the EU about additional explanations requested by Japan Customs from importers submitting a claim for preferential tariff treatment under the EU-Japan EPA.

Please see the link below:

http://www.customs.go.jp/roo/english/text/eu-3-16e.htm

The same info in Japanese:

http://www.customs.go.jp/roo/text/eu-3-16.htm

A Q&A guideline by the Commission, related to above aspect is available here: are the conclusions part

https://www.customs.go.jp/roo/procedure/riyou_eu_EN.pdf

It mainly results from that clarification for importers in Japan that:

It means the following for EU exporters:

Regarding the reference made at the end of the announcement, according to which ‘When necessary, verification may be conducted based on Article 3.21 of the EPA’, it refers to a procedural stage different from the one of the claim. Please see the part concerning that verification in the EU-Japan EPA Guidance on ‘Claim, Verification and Denial of Preference’.

6. Other regulations

Please note that the eligibility of benefiting of the preferential tariffs is conditioned to the respect of any other Japanese (or EU) import requirements: labelling, safety regulations, Japanese Industrial Standards, EU CE mark …

If your product does not comply with local regulations, then it cannot be imported in Japan / in the EU.

The EU-Japan Centre currently produces 5 newsletters :